Want To Be Broke Or Rich? This Chart Shows You How To Spend And Save Money

We all have a pretty good idea of how we should be handling our finances—spend less, save more.

But that’s easier said than done, and then there’s the tricky question of how much we should be saving versus spending each month.

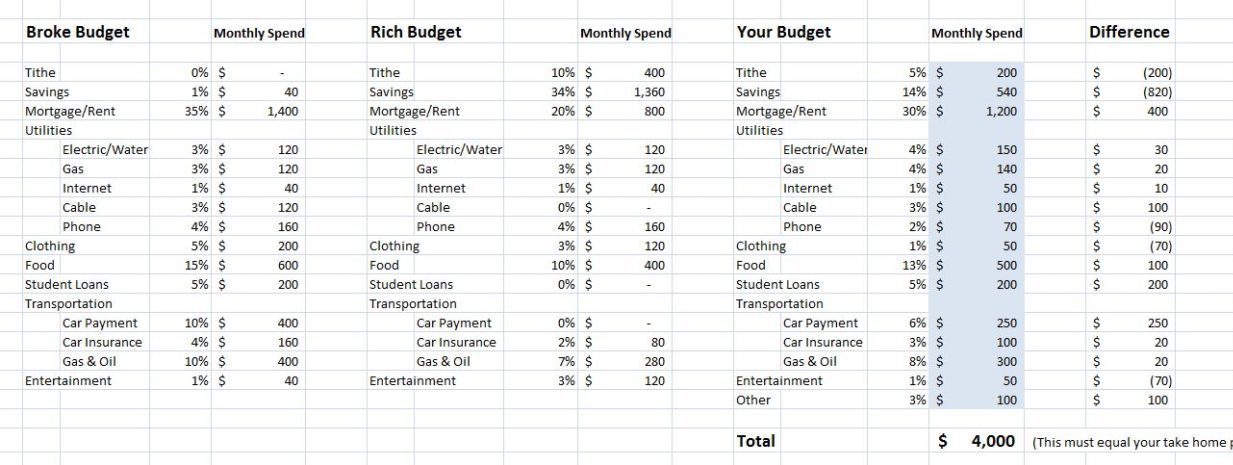

A spreadsheet from Life and My Finances, a personal finance blog, makes it easy.

This downloadable sheet lets you enter your monthly income and how much you’re spending on rent, utilities, clothing, food, transportation and other categories.

Here’s a tiny preview of what the spreadsheet looks like. You’ll want to visit Life and My Finances to download the full sheet, which is much larger and allows you to input your own numbers!

Then, using your information, the spreadsheet calculates two very different budget scenarios.

In the first scenario, called the “broke budget,” you’ll see how your income would be split up in a paycheck-to-paycheck lifestyle.

In the second, more pleasant scenario, the sheet shows you a breakdown that maximizes savings and reduces expenses.

RELATED: This Chart Helps You Check Your Family’s Grocery Budget

Even if you don’t end up following the “rich budget” breakdown exactly, the sheet is still helpful for analyzing your top spending areas, according to Lifehacker.

Of course, this is just one person’s opinion on how you should manage your finances, but the site recommends saving roughly 20 percent of your take-home pay each month and spending no more than a quarter of your monthly income on housing.

The site also recommends paying cash for older, more modest vehicles rather than taking out a loan on a brand new car. Just cutting out a car payment can help save you hundreds.

Having a fancy new car and a huge house may give the appearance of wealth to outsiders, but people who spend their money that way may actually be broke, the site argues.

“You know where that money goes if you’re not spending it on your house or your cars? Into your savings and investments,” notes the site.

The site also advocates for cutting down your grocery budget, which is easy to do if you shop less often, buy generic products and take other recommended steps.

Don’t worry—even if you’re stashing more in savings, you can still find cheap ways to treat yourself.

Looking for a little money inspiration? Read the story of Kelsey Shade, a mother of four who keeps her household budget under $300 a month!

Or, check out some of the money tips shared by this couple that was able to retire in their 30s! Now that is impressive.

RELATED: Here’s How Much Money You Need To Make To Be In The Top 1% Of Every State

Here are some additional tips on how to save money on your medical bills: