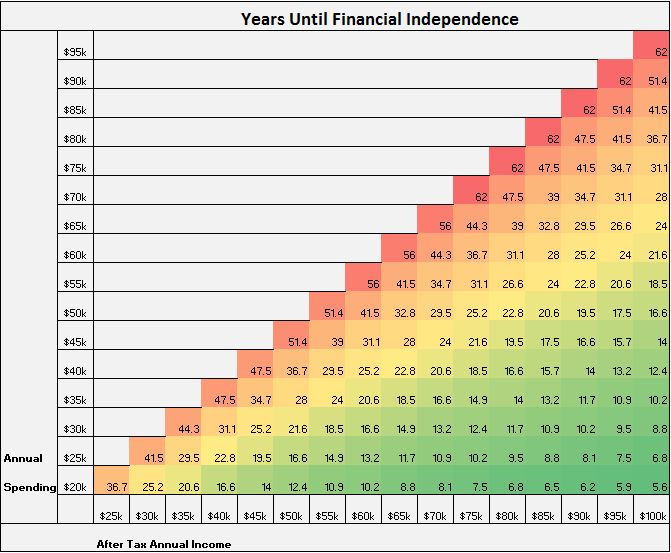

This chart shows how many years you need to work before you can retire

Many people are unaware of how much money they’ll need before retirement in order to live out the rest of their lives in security. Life expectancy has risen consistently over the years. In 1900, the average person lived to 47 years old. By 1999, the life expectancy had risen to 77 years.

Currently, a 65-year-old man has a 50 percent chance of living until the age of 87 and a 25 percent chance of seeing 93. Women tend to live even longer. For example, a 65-year-old woman could possibly ring in her 90th birthday with a 25 percent chance of seeing her 96th birthday.

MORE: This city is the No. 1 place to retire in America with no savings

The issue facing retirees, then, is the possibility of running out of money. If an individual retires at the age of 65, do they have enough money to last another 30 years without working? Four Pillar Freedom’s Early Retirement Grid can give you a pretty good idea:

How The Early Retirement Grid Works

With one look, you can see where you fall in the grid and make adjustments accordingly. The chart assumes you have retirement investments that earn 5 percent annually, and that you will need to withdraw 4 percent of your funds each year after retirement.

For example, if you bring home $40,000 each year after taxes and spend $30,000, you will have $10,000 left to invest into your retirement. You will need to work approximately 31 years to ensure that you have enough in your retirement fund to live on after retirement. The chart does not take into account any savings you may have already acquired.

To Invest More, Spend Less

Widening the gap between your net income and your spending amount can mean shaving years off the work grind. If you are currently bringing home $60,000, but only spending $30,000 and investing the remaining $30,000 each year, you can retire in just 16 years.

To invest more into your retirement fund, you’ll need to spend less by adhering to a budget and nixing excess spending. It can help, at the outset, to keep a close eye on your spending for one month to find any financial weak areas. This could lead to you cutting back on fast food, restaurants, excessive entertainment and retail therapy.

You could also assign a cash envelope for these spending areas with the vow to not spend anything more once the cash runs out until the next budget session or pay day.

Building an emergency fund could protect you from unexpected crises, such as having to replace the transmission in your vehicle or hiring a plumber for a water leak.

Armed with the information from the early retirement grid, begin investing more so you can enjoy your Golden Years for a long time.

The Psychology Of The Budget

If the word budget fills you with dread, you’re not alone. Why oh why is budgeting so hard? Why are budgets so hard to stick to? Turns out, science has the answer—and it makes total sense.

“I think the entire concept of budgeting is flawed,” Brad Klontz, a psychologist and certified financial planner told Science of Us. “Your emotional brain responds to the word budget the same way it responds to the word diet. The connotation is deprivation, suffering, agony, depression.”

Ah ha! What I was feeling when trying to stick to a budget was not unlike what someone feels when dieting. Research shows that physical and financial health are connected, and they’re both hard to stick to for similar psychological reasons.

Just like dieting, budgeting conjures up images of suffering, giving things up (good things, like donuts and shopping!) and making forced sacrifices.

And just like with a diet, a budget can be easy to stick with in the short term, but almost impossible in the long term.

Apparently, your brain can get behind the idea of suffering for a few days or weeks. But forever? No way.

When your brain is convinced that you’re depriving yourself of something, whether that’s money or food, you start to want what you can’t have. This makes sense to anyone who’s tried to cut carbs for any length of time (give me all the cookies!).

We Need Your Help: Take Our Vacation Survey (And Enter To Win A $100 Gift Card!)

Instead of thinking about the real reason you’re budgeting (maybe you’re saving for an awesome new house that will make you super happy), all you’re thinking about is what you can’t have (a new dress from Amazon). The same goes for food.

“When you are dieting, you actually become more likely to notice food,” University of Minnesota professor Traci Mann told the Washington Post. “Basically your brain becomes overly responsive to food, and especially to tasty looking food. But you don’t just notice it — it actually begins to look more appetizing and tempting. It has increased reward value. So the thing you’re trying to resist becomes harder to resist. So already, if you think about it, it’s not fair.”

So what’s the best way to fight these feelings so you can budget and save effectively?

Five Tips For Budgeting With Your Psychology

1. Change Your Approach

Create a spending plan focused on your goals, Klontz suggests. It may not seem that different from a budget, but supporting your goals by controlling your spending has a different effect on your brain. Add another layer by visualizing your goals. Save a picture of a beach vacation or a new car on your phone to motivate yourself.

In practice, a spending plan is just like a budget. But the way you’re framing it for your brain is totally different.

“You get really excited about things you want to spend money on. And then you want to cut back on the things that don’t matter,” Klontz told Science of Us.

2. Baby Steps

Make your goals manageable. Saving for retirement is so far away, it’s tempting to get a quick hit by spending on something fun now. Try to break up your goals into smaller milestones (like saving $300 a month) so you don’t get off track.

3. Plan For Your Missteps

Plan for overspending. Research has found that people tend to incorrectly estimate their monthly spending and are better at planning yearly because they pad it more. It’s also why I was down on myself for going over on my monthly budget plans. Work on understanding where your money is going and pad it upfront rather than making up for it later.

4. Visuals Are Key

Visualize your future self. A New York University study found that people who could visualize their future self saved more for retirement. You can take it a step further by thinking about what you want your retirement to be like. Having a better idea of where you want to live and travel or what you want to enjoy while retired will get you more excited about saving for those goals.

5. Snowball Your Debts

Psychology is full of all sorts of mind tricks that can help improve your overall financial picture. If you’re staring at several different types of debt, try to make the minimum payment on each account, then put all of your efforts into paying off the smallest debt first. This is called the snowball method. When you’re able to completely pay off one account balance, you can actually see your progress, which motivates you to keep paying off the rest of your debt.

RELATED: Here’s How Much Money You Need To Save Each Day To Become A Millionaire

Amanda Stout contributed to this report.