How much money you need to save each month to become a millionaire

Becoming a millionaire can seem like a pretty lofty goal — or even just a fantasy. But according to financial adviser David Bach’s 2002 book “Smart Couples Finish Rich,” all it takes is a little planning.

MORE: This city ranks first for retirement with baby boomers

Start Early (Or, At Least, Now!)

According to Bach, the key to getting rich is sticking to a savings and investment plan as early as you can.

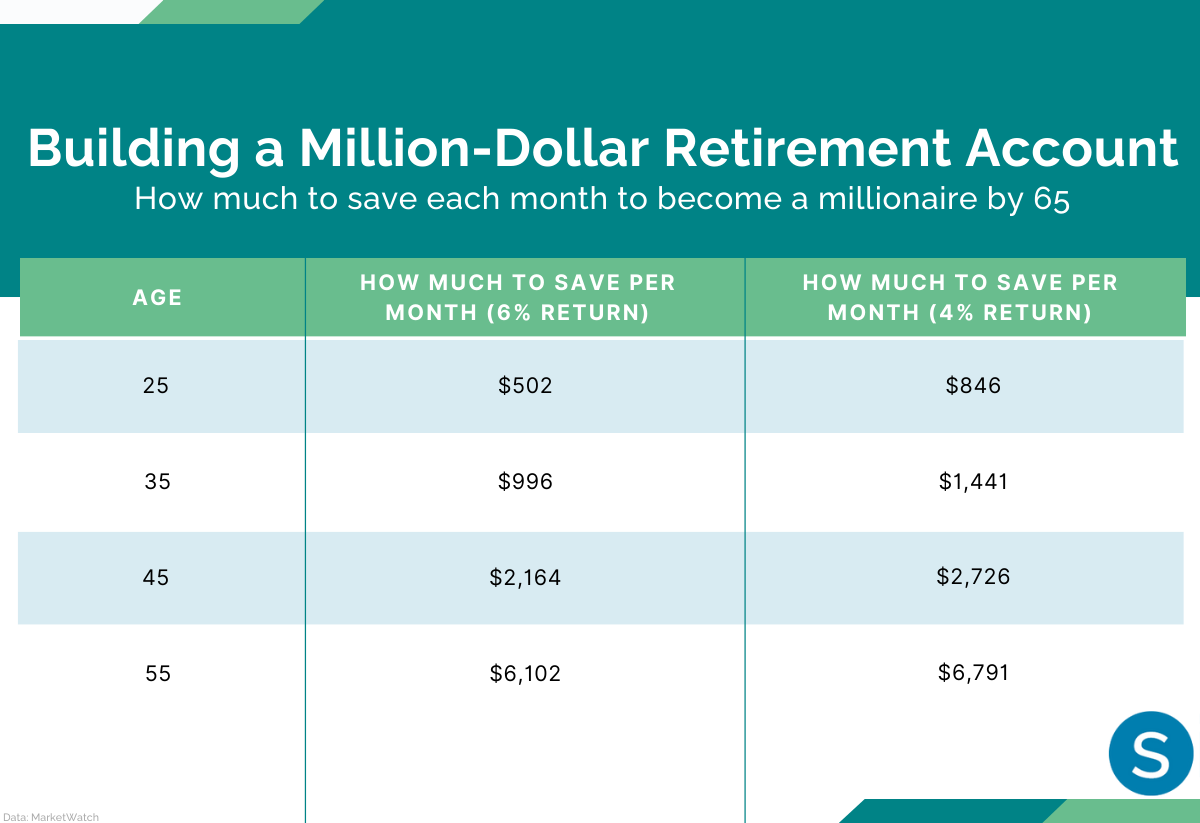

Bach created a chart, which we’ve recreated using updated data from 2022 from MarketWatch, to illustrate how you can build your wealth over the years.

MORE: Woman hits jackpot on online lottery game while waiting for kids to go to bed

The Key Is To Invest

The key to accumulating wealth is to not just save money but to invest and let it multiply. According to the authors of “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy,” millionaires invest 20% of their income on average — and the majority of them live well below their means. Robert T. Kiyosaki’s advice is similar in his bestselling book “Rich Dad, Poor Dad: What The Rich Teach Their Kids About Money That The Poor And Middle Class Do Not!”

Earning a lot of money won’t automatically lead to wealth. It’s how much you keep and what you do with it that counts.

It’s Not Too Late To Start Saving

Whether you are just starting to save money now or want to increase your investments (to get that return), the process can be confusing and overwhelming. Don’t give up, though.

As “The Millionaire Next Door” authors William Danko and Robert Stanley advise, financial planning takes time — but it’s time very well spent.

The long and short of it: The next time you’re thinking of getting that coffee or green juice, you might want to consider setting that money aside instead. It will definitely pay off in the long run.

MORE: This man built an Airbnb treehouse that let him quit his job