Here’s One Way To Save Enough Money To Buy A House By Age 30

Think through all the advice we’ve heard growing up.

“Actions speak louder than words.”

“Don’t lick a frozen pole.”

“The art is not in making money, but in keeping it.”

Even though we know we need to save, we’re not very good at keeping the green stuff from being spent. This matters even more when it comes to the example we’re setting for our kids. How do we teach our kids about financial responsibility when we are trying to figure it out ourselves?

RELATED: Here’s how to become a millionaire earning just $56,000 a year

This one blogger’s come up with an idea we all can learn from. This not only works for kids, but for any adult who needs to save a little extra. The blogger behind Ben and Me breaks down her recommended plan, which in this case involves starting to save at age 15.

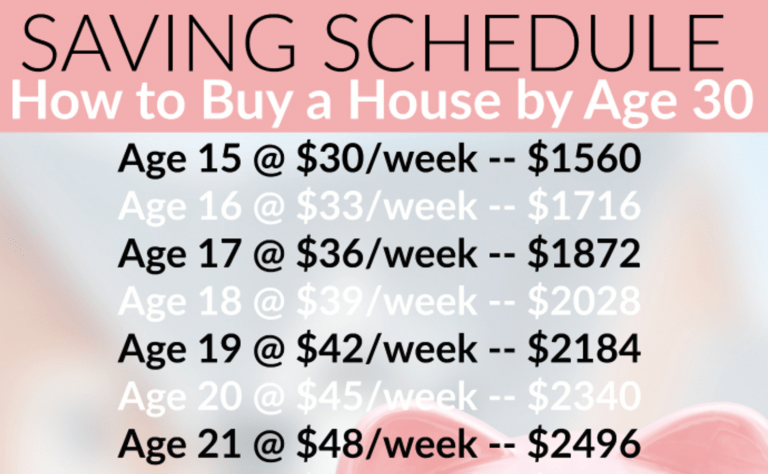

The concept is simple — begin with $30/week, and continue increasing the savings amount by $3/week every year on his birthday. The idea is that after one year of saving weekly, another $3/week will not be that noticeable. Also, as he gets older, he will likely have the opportunity to earn more money.

Here’s the visual she created to outline this brilliant saving schedule:

Marcy Crabtree, the brains behind this blog. said she came up with this idea after her son Ben had a realization about the cost of houses:

“Recently, he overheard a conversation between my husband and me, when we were discussing the balance of our mortgage. Remembering that conversation, Ben later asked me how buying a house worked. This began a discussion on the ins and outs of home ownership, including financing such a large purchase. When we came to the part of needing a large sum of money up front as a down payment, his eyes got huge — ‘How do people save that much money??!!'”

Teaching Kids About Money

Crabtree says she grew up watching her single mom struggle to pay the bills and rack up tons of credit card debt. Because she didn’t know any differently, Crabtree says she initially followed a similar money path.

But she wanted something different for her son.

“One of my goals during Ben’s high school years is to teach him many life skills, including financial responsibility,” she wrote.

And, after introducing Ben to the weekly saving chart, it seems she’ll have no problem achieving that goal.

“Ben was pretty impressed with how quickly the money adds up, and likes the idea of being able to buy his own house at such a young age (much younger than most people are able). In fact he asked me to print out the schedule to hang on his wall to motivate him both to seek out ways to earn money and remember that saving is important for his future goals,” she wrote.

Save Early, Save Often

The biggest takeaway is not the amount of money, but the consistent action of saving money. Start small, then keep saving more and more each year. Even if you only start saving $5, you’ll thank yourself later for taking this advice.

And it’s not like you (or your kids, if you’re helping them save) have to buy a house with the savings. Maybe they’ll look at the housing market and decide to wait.

RELATED: Here’s How You Can Make Up to $40 an Hour Running Errands For The Elderly

Maybe your kid really wants to go to a great college that costs more money than a house. Or maybe they want to start their own business with their savings, investing in their future. Maybe it’ll be the nest egg you’ve never had but always wanted in case of emergency.

No matter the reason why you’re saving, it helps to have a roadmap to get you started. Start (or keep!) saving now to give your kids an example of good financial responsibility, and your actions will no doubt help them learn to save for themselves one day as well.