What annual salary do you need to live comfortably in the US?

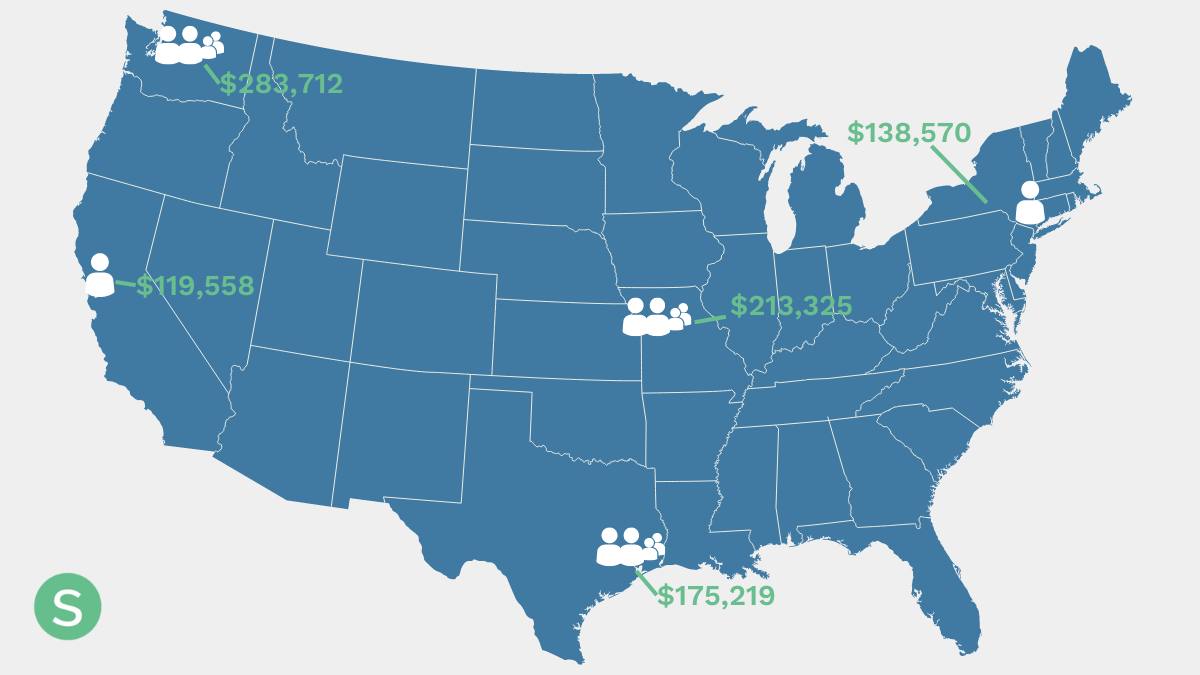

Americans must earn nearly a three-figure salary to live comfortably, according to a new study released by the financial service SmartAsset — and in some cities, much more.

Data from the study shows that an individual must have an average salary of at least $96,500 “for sustainable comfort in a major U.S. city.” For a family of two adults with two children, the average combined income requirement jumps to $235,000. In six major cities, the cost to raise a family with two children comfortably means you’ll need to earn over $300,000.

MORE: This city ranks first for retirement with baby boomers

In its analysis of cities across the U.S., SmartAsset also broke the data down into the most and least expensive cities for affording a comfortable lifestyle, which we’ve illustrated in the infographic below:

What Does ‘Live Comfortably’ Mean?

In the terms of the 2024 SmartAsset study, researchers define “living comfortably” by the 50/30/20 budget recommendation. This budget model allocates income in three different categories: needs, wants and debt/savings:

- 50% of your income goes toward needs, including housing, utilities, insurance, food, etc.

- 30% of your income goes toward wants, including entertainment, vacations, dining out, etc.

- 20% of your income goes toward debt/savings, including paying off credit cards, emergency funds, student loan payments, etc.

The 50/30/20 budget plan is just one way people can budget their money. However, for the purpose of the study, SmartAsset decided on this method to review salary data.

MORE: These are the best places to live in the US, according to annual rankings

How Was The Data Calculated?

SmartAsset reviewed data from the MIT Living Wage Calculator, which shows the local wage rate a full-time worker requires to cover the cost of basic needs where they live. Taking cost data from 99 of the largest U.S. cities, SmartAsset applied those numbers to the 50/30/20 budget model.

All of the data collected was updated as of Feb. 14, 2024.

5 Most Expensive U.S. Cities To Live Comfortably

After doing the calculations, SmartAsset ranked the following as the most expensive U.S. cities to live comfortably, based on the study guidelines. We’ve broken down the salary requirements below from the study’s findings for the five most expensive U.S. cities:

1. New York City, New York

- Single adult hourly wage: $66.62

- Single adult annual salary: $138,570

- Combined salaries for two working adults with two children: $318,406

2. San Jose, California

- Single adult hourly wage: $65.74

- Single adult annual salary: $136,739

- Combined salaries for two working adults with two children: $334,547

3. Irvine, California

- Single adult hourly wage: $60.96

- Single adult annual salary: $126,797

- Combined salaries for two working adults with two children: $291,450

4. Santa Ana, California

- Single adult hourly wage: $60.96

- Single adult annual salary: $126,797

- Combined salaries for two working adults with two children: $291,450

5. Boston, Massachusetts

- Single adult hourly wage: $60.08

- Single adult annual salary: $124,966

- Combined salaries for two working adults with two children: $319,738

5 Least Expensive U.S. Cities To Live Comfortably

Based on the study findings, here are the five least expensive U.S. cities where you can live comfortably. Texas, the Lone Star State, scored four of the top five locations!

1. Houston, Texas

- Single adult hourly wage: $36.10

- Single adult annual salary: $75,088

- Combined salaries for two working adults with two children: $175,219

2. El Paso, Texas

- Single adult hourly wage: $36.18

- Single adult annual salary: $75,254

- Combined salaries for two working adults with two children: $180,461

3. Lubbock, Texas

- Single adult hourly wage: $36.24

- Single adult annual salary: $75,379

- Combined salaries for two working adults with two children: $181,043

4. Toledo, Ohio

- Single adult hourly wage: $37.26

- Single adult annual salary: $77,501

- Combined salaries for two working adults with two children: $208,416

5. Laredo, Texas

- Single adult hourly wage: $37.72

- Single adult annual salary: $78,458

- Combined salaries for two working adults with two children: $179,046

You can review the full list of cities or search for the nearest city to your home with the data chart below. The chart starts with the least expensive city in the No. 1 spot.

How Does This Data Compare To A Family Budget Calculator?

The Economic Policy Institute (EPI) has a Family Budget Calculator to help determine a "modest, yet adequate standard of living." Their financial benchmarks include housing, food, child care, transportation, health care and other necessities and taxes.

We input the data for both the most expensive and least expensive cities from the SmartAsset study into the EPI Family Budget Calculator and found the following:

New York City Metro Area

Single person costs:

- Monthly: $5,821

- Annual: $69,852

- Required hourly rate (based on a 40 hour work week): $36.38

Two adults, two children costs:

- Monthly: $12,253

- Annual: $147,041

- Required hourly rate: $43.76 per adult

Houston Metro Area

Single person costs:

- Monthly: $3,738

- Annual: $44,850

- Required hourly rate: $23.36

Two adults, two children costs:

- Monthly: $7,924

- Annual: $95,093

- Required hourly rate: $24.76 per adult

What Do These Numbers Mean?

With a federal minimum wage set at $7.25 per hour and state minimum wages ranging from $7.25 to $17, both sets of data show a significant gap between what people can earn and the rising costs of living across the country. They also highlight the challenges many Americans face to make ends meet and why up to 70% of people say they are living paycheck to paycheck.

When looking at relocating for work or personal reasons, you might want to take a closer look at these numbers to plan for new expenses compared to your salary, and how they might affect your standard of living.