Use this calculator to see how the tax bill will impact your paycheck

Update 12/20/17 at 2:30 p.m. EST: Congress has passed the tax bill, and it’s headed to the White House for President Donald Trump’s signature.

Once word of a tax reform bill made its way from the White House, people across the country were wondering one thing: How will this affect my bottom line?

Well, thankfully, The New York Times has tool that can easily map out an estimate of what your after-tax income will look like in 2018—so, there won’t be any surprises.

All you have to do is enter your salary range, the way you file your taxes (single, joint or head of household), how many children you have and if you took the standard deduction this year.

And then, voila, the calculator shows you how much your after-tax income will increase or decrease each year under the proposed tax bill.

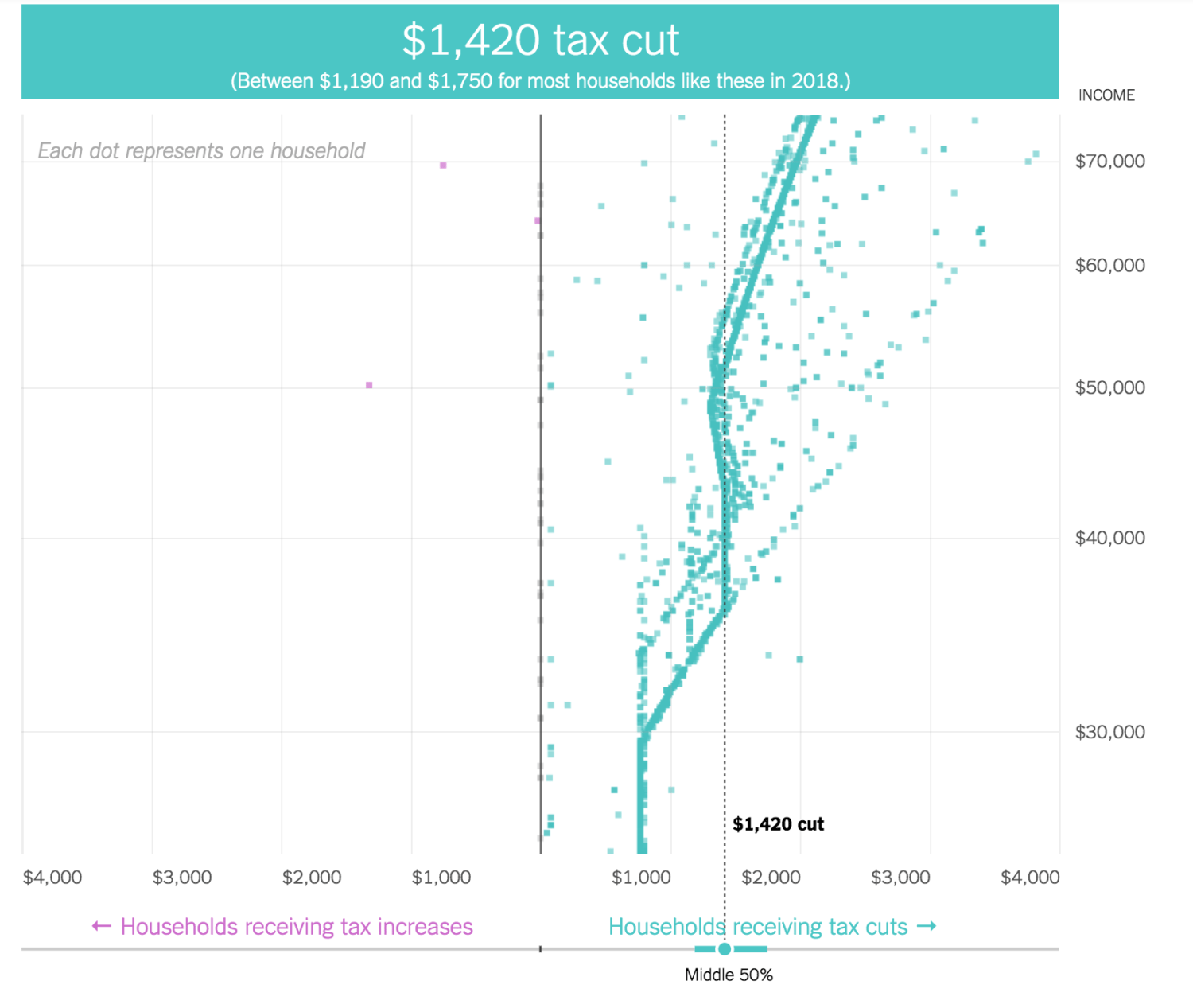

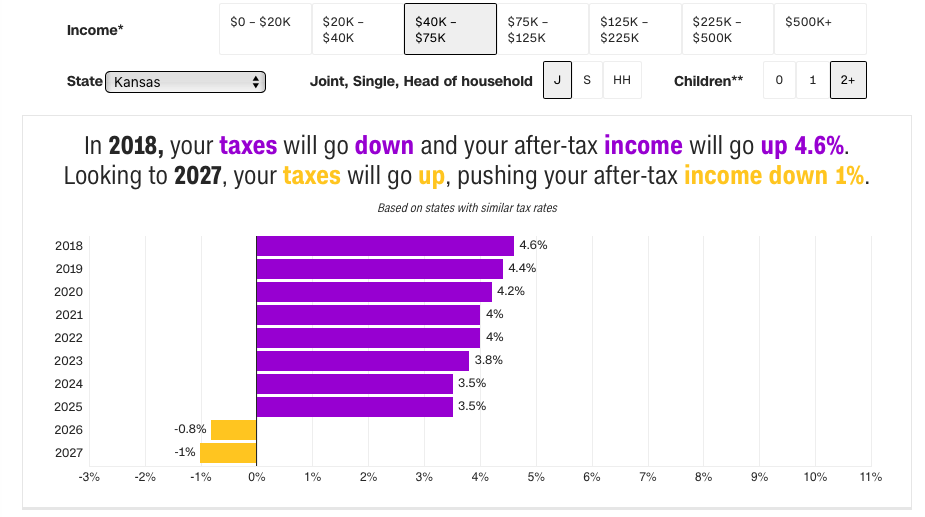

For example, if you live in Kansas, earn between $25,000 and $75,000 a year, are married and file jointly, and have two children, here’s the impact you can expect to see on your after-tax income:

Pretty handy, huh? Visit The New York Times to try it yourself. If you are on a desktop computer, you can try CNN’s calculator for yourself (it won’t work on mobile).

Here’s how that same family (earning between $40,000 and $75,000) would fare, according to CNN:

Most After-Tax Income Will Go Up

In pretty much any scenario, you’ll see increases in your after-tax income—at least initially. But by the year 2026, taxes for many people are expected to increase.

The calculator was created based on the Senate-passed bill, but at the time of publication, the Senate and House had worked to reach an agreement.

However, on Dec. 14, Sen. Marco Rubio (R-Florida) said he would not vote for the bill unless it includes a child-tax credit that benefits poor working families. So, it remains to be seen whether the bill will be passed by President Trump’s Christmas deadline.

According to CBS, if you look at the combined bill in broad terms, it’s the wealthy and corporations that will reap the greatest rewards from this tax bill.

People in the top tax bracket would see their rates drop from of 39.6 percent to 37 percent, and corporate taxes would decrease from 35 percent to 21 percent.

The goal is to have the final bill in the White House by Christmas. Some think voting on the bill should be delayed until newly-elected Alabama senator, Doug Jones, is sworn in, but others see this as a way for the passing of the bill to be sped up.

“The Doug Jones victory in Alabama should serve as the final nail in the coffin of the tax-reform bear thesis,” Isaac Boltansky, a policy analyst at the research firm Compass Point, told Business Insider. “This electoral defeat will bolster the already gale-force tailwind behind the GOP’s tax-reform effort.”

If passed in time, the bill would take effect on Jan. 1, 2018, but Americans wouldn’t see the changes on their tax returns until 2019. For more information on the original House bill, the original Senate bill and the combined version see this detailed comparison.